.jpg?width=407&resizemode=force)

The Vitesco Technologies Group became part of the Schaeffler Group as of October 1, 2024, due to the merger of Vitesco Technologies Group AG into Schaeffler AG.

Please note: Legal or actual changes since October 1, 2024, are therefore no longer reflected in the content of the website.

As the website is no longer updated, we assume no liability for the content of this website, or the linked websites contained therein. The operators of the linked sites are solely responsible for their content.

Irrespective of this, you can still find the current BPCoC and the General Terms and Conditions of Purchase at Vitesco Technologies - Suppliers (vitesco-technologies.com)

Under the following link you will find the current Schaeffler website:

.jpg?width=407&resizemode=force)

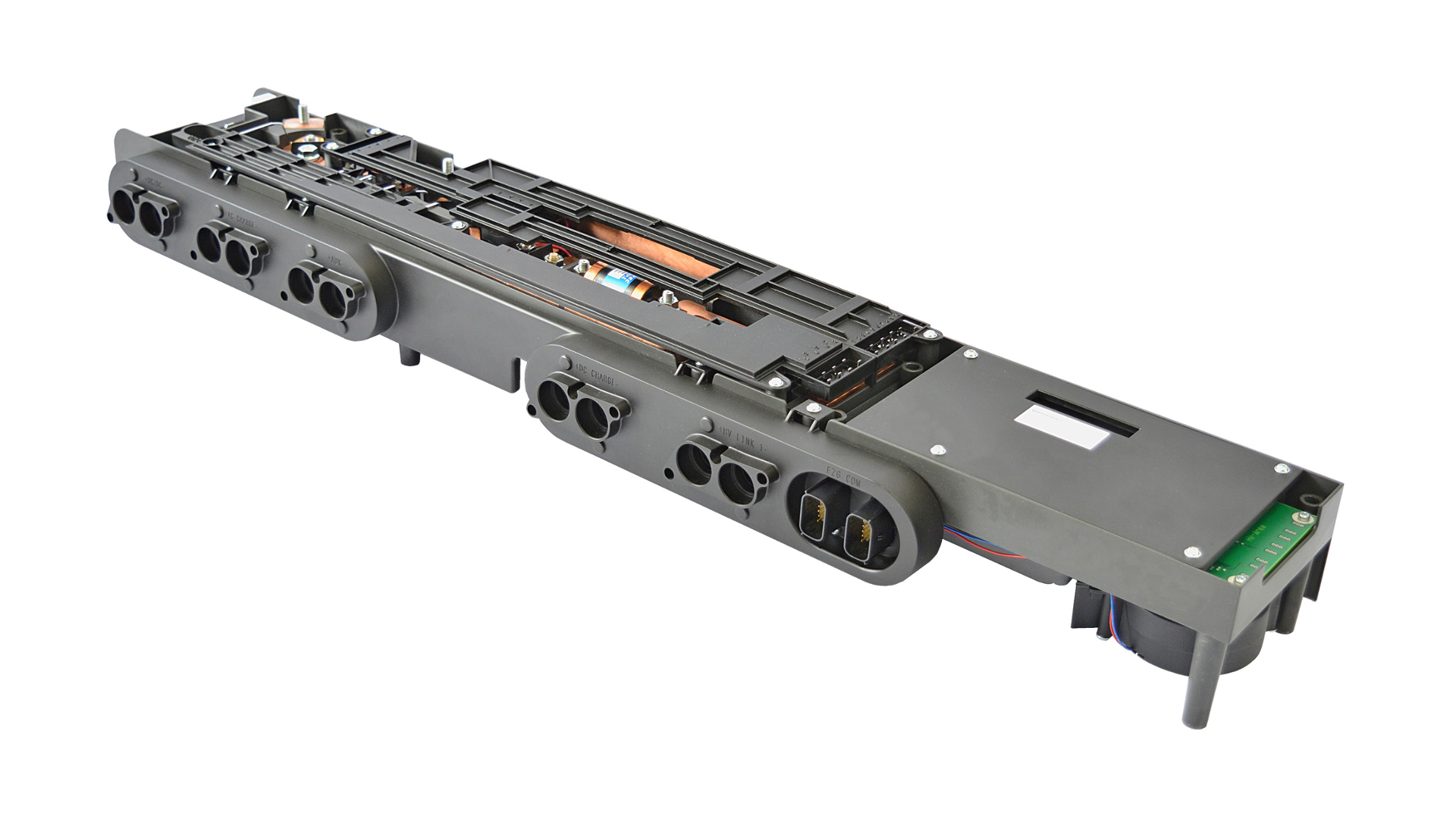

Regensburg, November 11, 2021. Vitesco Technologies, a leading international developer and manufacturer of state-of-the-art powertrain technologies for sustainable mobility, today announced its third quarter results for 2021. The quarter remained impacted by the effects of the Covid pandemic as well as shortages in global supply and logistics chains. However, Vitesco Technologies also marked the past quarter with a historic achievement.

The successful listing on the Frankfurt stock exchange following the spin-off from Continental on 16 September 2021 marks a milestone in the corporate history of Vitesco Technologies. With a transaction volume of just under € 2.4 billion, this was also one of the larger stock exchange listings in Germany in recent years. Subsequently, Vitesco Technologies operates as an independent company in the dynamically growing electromobility market. Electrification products are expected to account for the majority of revenues by 2030.

Solid results in a demanding market environment

Group revenues in the third quarter were € 1.9 billion (Q3 2020: € 2.2 billion). Adjusted for changes in the scope of consolidation and exchange rate fluctuations, revenues fell by 14.9 percent. Nonetheless, Vitesco Technologies was resilient in a challenging market environment. Organic sales growth in the third quarter outperformed by nine percentage points above the underlying global automotive production volume. Adjusted operating profit fell year-on-year to € 22.8 million (Q3 2020: € 102.2 million) due to the ongoing semiconductor crisis. This corresponds with an adjusted EBIT margin of 1.2 percent (Q3 2020: 4.7 percent).

The volume of new orders booked in the third quarter was € 2.6 billion, roughly 30 percent of which, approximately € 770 million, accounted for electrification products across all business units.

As of 30 September 2021, Vitesco Technologies has a solid balance sheet with an equity ratio of 37.1 percent (30 September 2020: 33.9 percent). The change in equity ratio compared to the year before is primarily due to the asset reduction as part of the spin-off, largely through the consolidation of financial receivables and liabilities with Continental AG.

“Our industry continues to face major challenges: The Covid pandemic persists and the shortage of components, especially semiconductors, is affecting the entire industry severely. Against this backdrop, we still delivered a solid quarter,” said Andreas Wolf, CEO Vitesco Technologies. “With strong cost discipline and our focus on operational efficiency, we were able to compensate the tight supply situation in the semiconductor market to a significant extent,” adds Werner Volz, CFO Vitesco Technologies.

CEO Andreas Wolf: “The market environment will continue to be challenging in the coming months, and we do not expect supply chain shortages to ease significantly before year-end 2022. But what is important for us is that the underlying market dynamics toward e-mobility are still intact. In this respect, we are pushing ahead with our transformation strategy in a targeted manner. This enables us to fully exploit the attractive growth opportunities offered by e-mobility.”

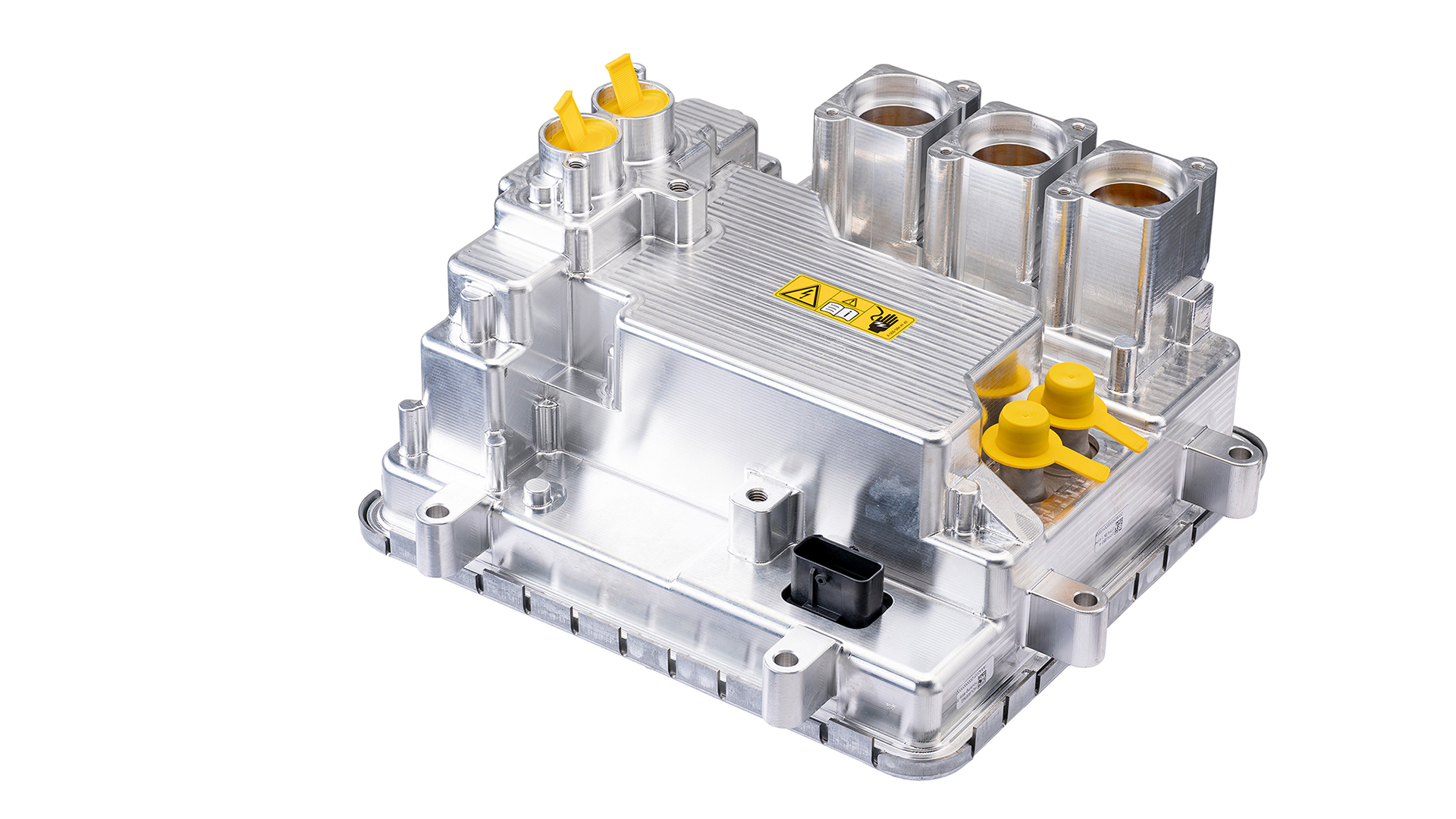

Business unit results

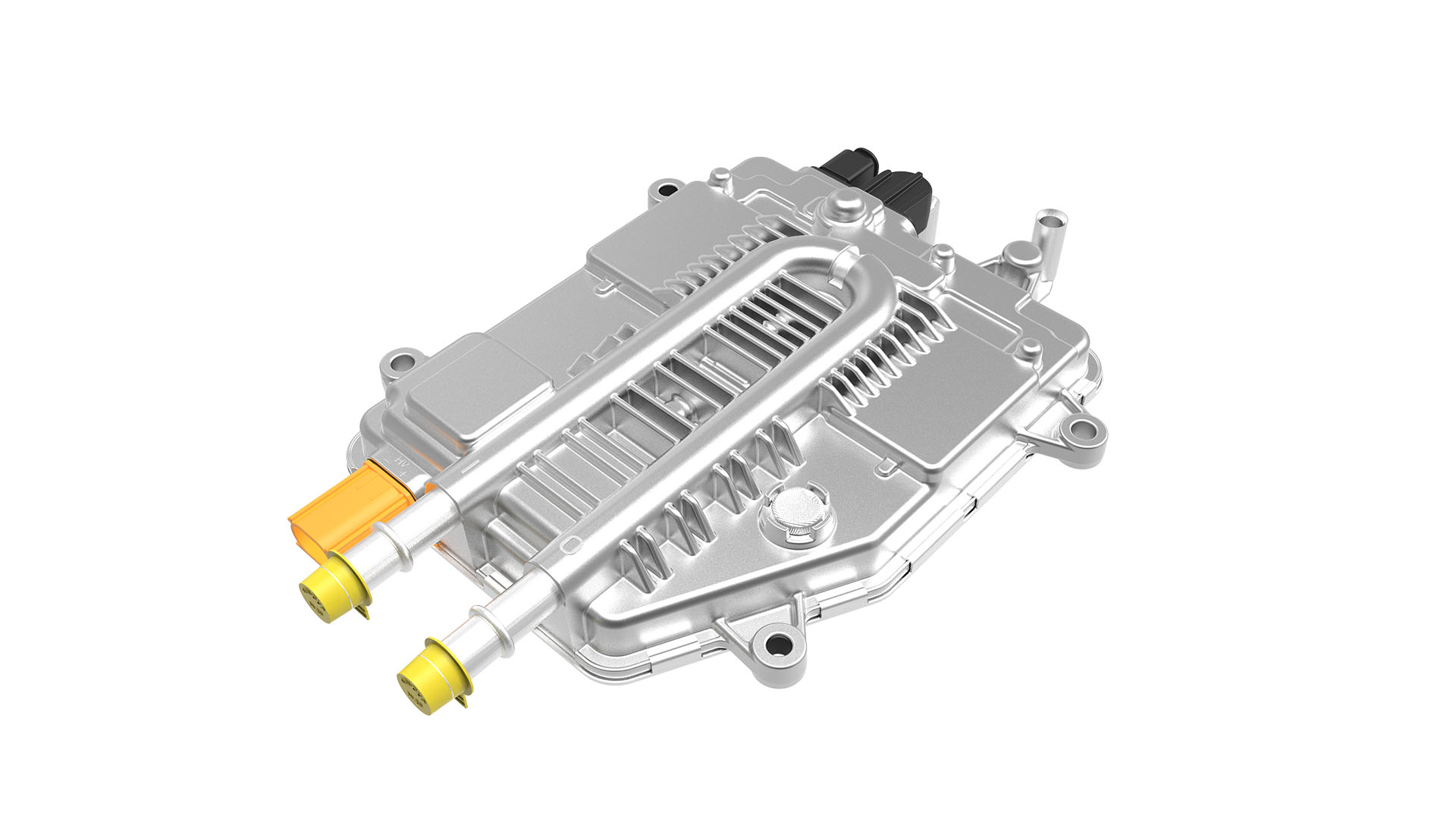

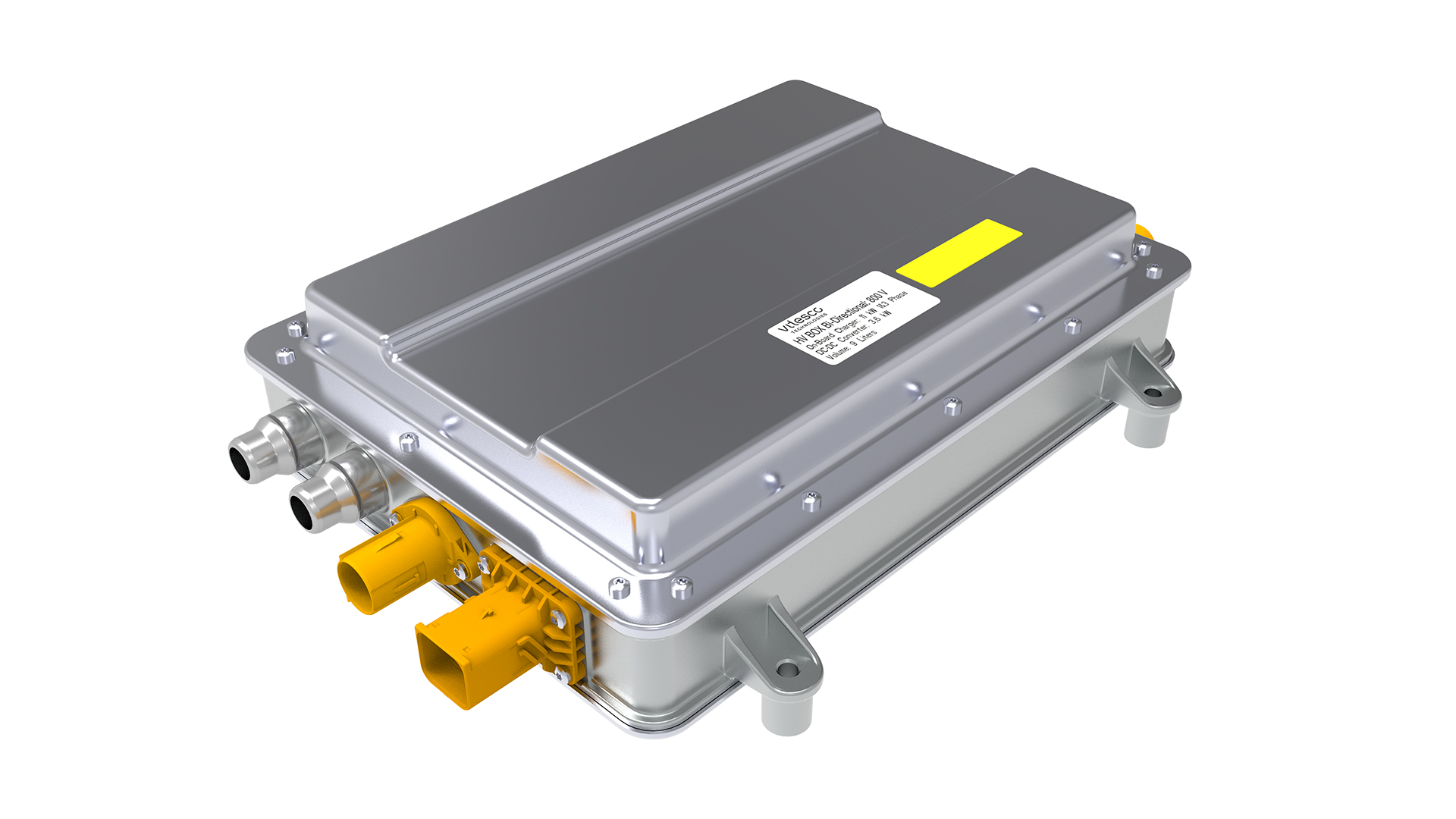

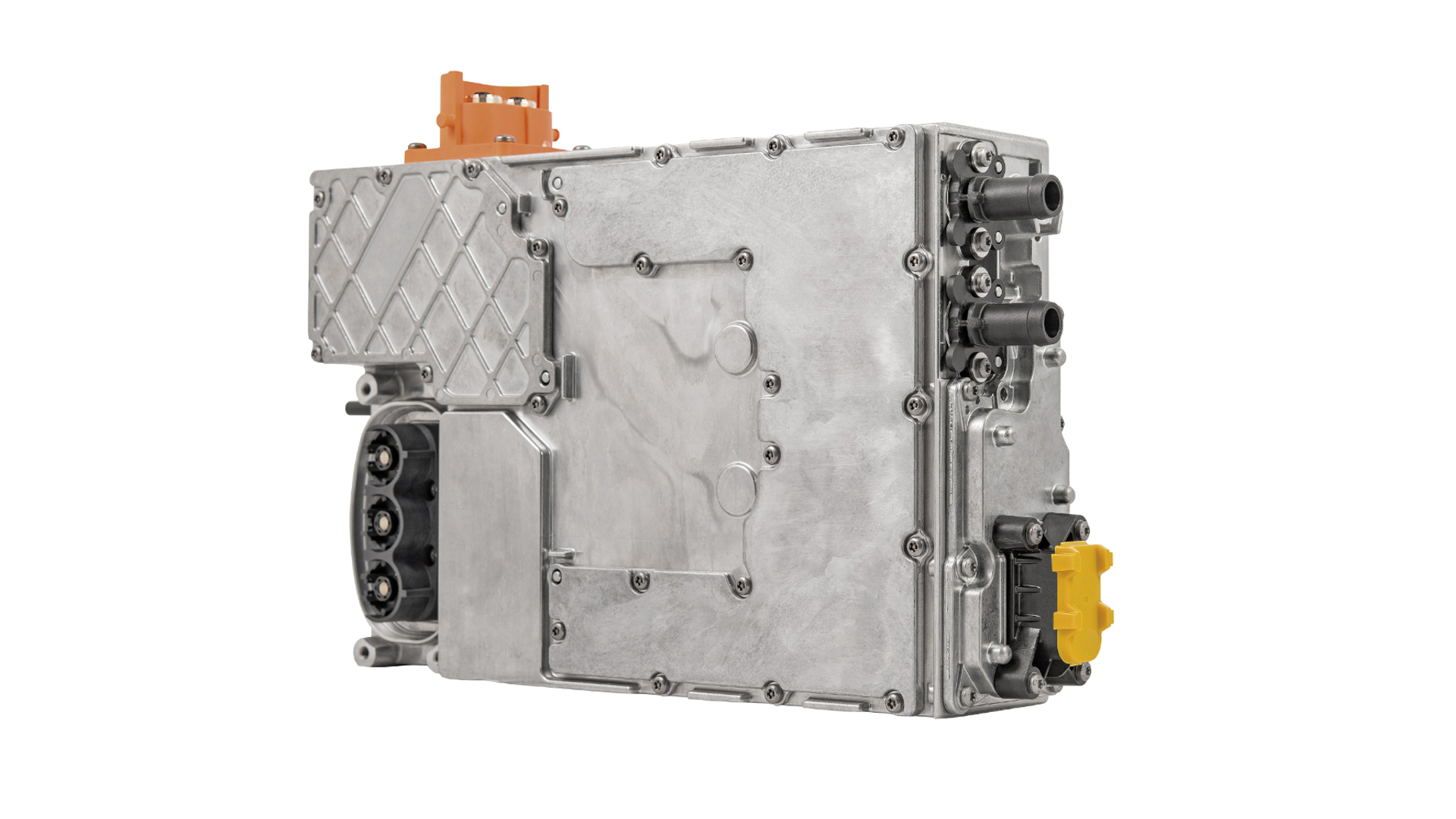

Electrification Technology reported revenues of € 128.9 million in the third quarter 2021 (Q3 2020: € 132.3 million). Despite continued high demand for high-voltage electric drives and performance electronics, the development of the semiconductor market also led to a decline in sales in Electrification Technology. Adjusted operating profit decreased to € -69.2 million (Q3 2020: € -61.8 million), corresponding to an adjusted EBIT margin of -53.7 percent (Q3 2020: -46.7 percent). Nonetheless, improvements in the gross margin were achieved year-on-year.

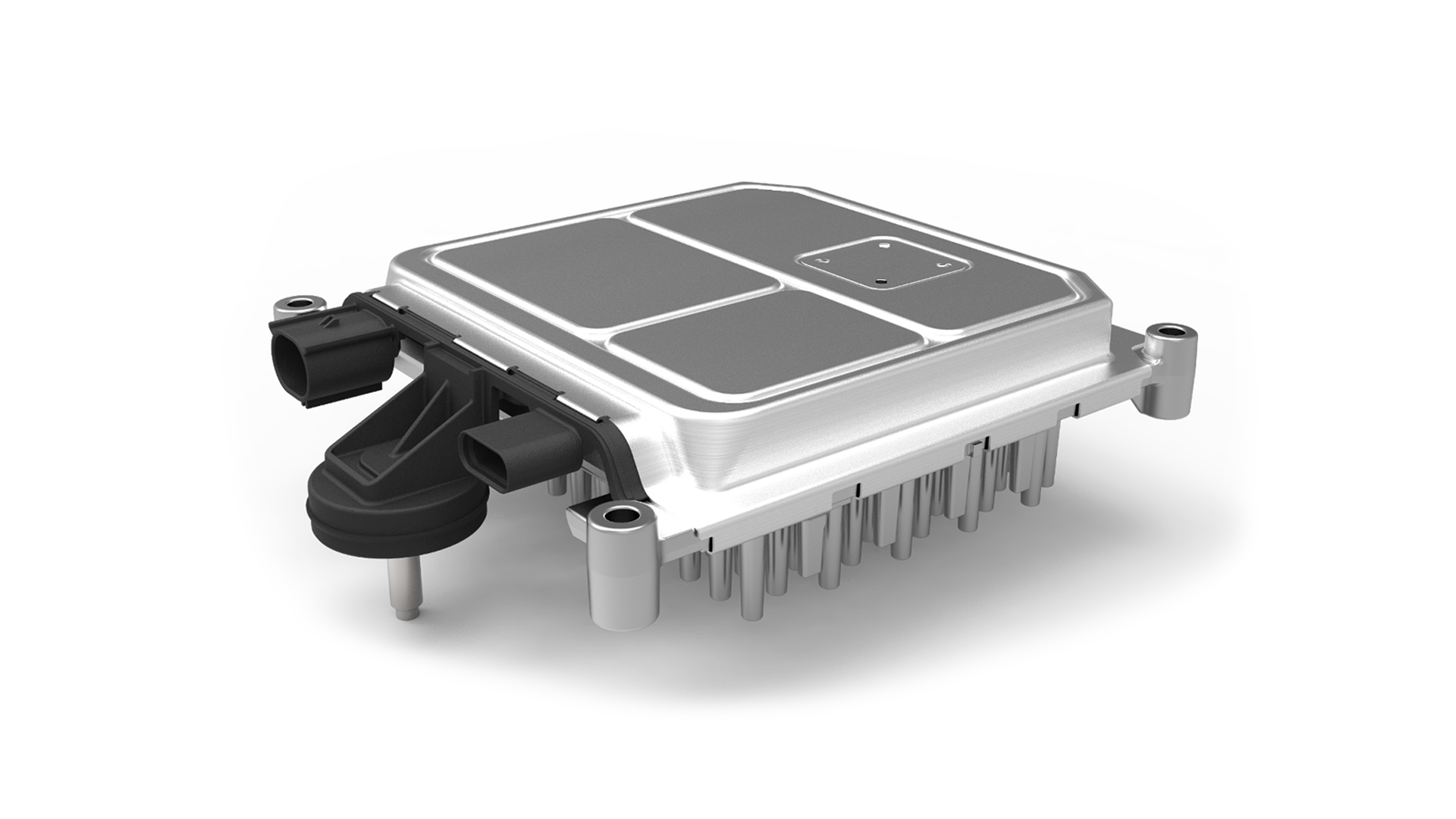

In the Electronic Controls business unit, revenues in Q3 2021 were € 806.8 million (Q3 2020: € 996.9 million). Adjusted operating profit was € 29.4 million (Q3 2020: € 68.7 million), corresponding to an adjusted EBIT margin of 3.6 percent (Q3 2020: 6.9 percent). Higher costs as well as a loss of sales due to the semiconductor market situation were particularly apparent in Electronic Controls.

In Sensing & Actuation, sales in the third quarter 2021 amounted to € 746.7 million (Q3 2020: € 775.7 million). The effects of the semiconductor shortage, especially due to higher material costs, were also noticeable in this business unit. However, the positive demand development in China and parts of Europe partially compensated for the additional costs. Adjusted operating result amounted to € 52.5 million (Q3 2020: € 71.9 million), corresponding to an adjusted EBIT margin of 7.0 percent (Q3 2020: 9.3 percent).

Outlook for the full year 2021

Vitesco Technologies expects the market environment to remain challenging in the fourth quarter. Persistent semiconductor supply shortages will continue to result in higher material and logistics costs. Missing parts may also lead to short-term demand adjustments and production standstills. Against this backdrop, the global automotive market is unlikely to reach the sales levels of the fourth quarter 2020.

For the 2021 financial year, Vitesco Technologies expects global light vehicle production to stagnate at or slightly above the previous year's level. While the North American market should be stable compared to the previous year, a decline of about three percent is expected for Europe. For the Chinese market, Vitesco Technologies also anticipates a slight decline of about one percent.

Despite these developments, the company expects a slight increase in revenues compared to the previous year to around € 8.2 to € 8.4 billion. Resulting from continued strong cost discipline and further progress in the transformation of the company, an adjusted operating EBIT margin of approximately 1.5 percent to 1.7 percent is expected for the full year 2021. The capex ratio without the value in use (IFRS 16, leasing) for 2021 will range between approximately 5.2 percent to 5.5 percent. Overall, a free cash flow of roughly € 70 million to € 120 million is expected for the 2021 financial year.

© Vitesco Technologies GmbH (exclusive rights)