.jpg?width=407&resizemode=force)

The Vitesco Technologies Group became part of the Schaeffler Group as of October 1, 2024, due to the merger of Vitesco Technologies Group AG into Schaeffler AG.

Please note: Legal or actual changes since October 1, 2024, are therefore no longer reflected in the content of the website.

As the website is no longer updated, we assume no liability for the content of this website, or the linked websites contained therein. The operators of the linked sites are solely responsible for their content.

Irrespective of this, you can still find the current BPCoC and the General Terms and Conditions of Purchase at Vitesco Technologies - Suppliers (vitesco-technologies.com)

Under the following link you will find the current Schaeffler website:

.jpg?width=407&resizemode=force)

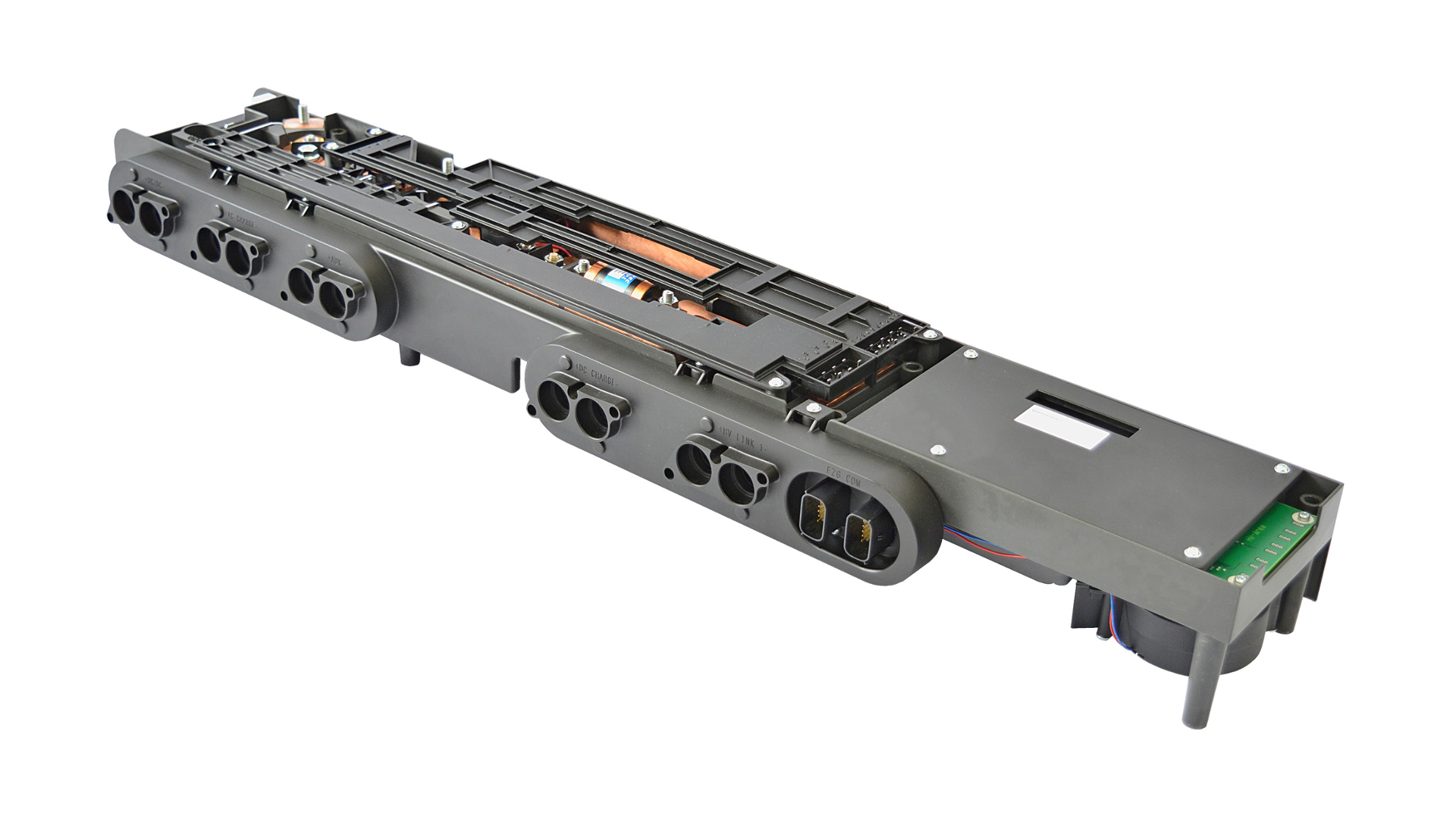

Regensburg, November 14, 2023. Vitesco Technologies, a leading international provider of modern drive technologies and electrification solutions for sustainable mobility, published its results for the third quarter of 2023 today.

Group sales amounted to €2.20 billion in the third quarter of 2023 (Q3 2022: €2.30 billion). The decrease in sales in the quarter was mainly due to the planned ramp down of non-core business. Adjusted for changes in the scope of consolidation and exchange-rate effects, organic sales growth was at 1.1 percent.

Sales in the electrification business amounted to €324 million in the third quarter of this year, an increase of around 30 percent compared to the same quarter of 2022.

Adjusted EBIT increased year on year to €76.4 million (Q3 2022: €44.7 million), which corresponds to an adjusted EBIT margin of 3.5 percent (Q3 2022: 2.0 percent). The main reason for the increase were operational improvements in the core business.

Net income came in at €30.3 million (Q3 2022: net loss of €13.8 million), which corresponds to earnings per share of €0.76 (Q3 2022: loss per share of €0.34).

Despite higher capital expenditures ahead of new project launches, free cash flow improved to €73.4 million in the third quarter of 2023 thanks to increased profitability (Q3 2022: minus €16.3 million). Vitesco Technologies had a solid balance sheet as of September 30, 2023, with an equity ratio of 40.6 percent (September 30, 2022: 40.7 percent).

Volume of electrification orders remains robust

Order intake in the third quarter amounted to €2.5 billion, of which approximately 60 percent (around €1.5 billion) related to electrification products. In the first nine months of the year, order intake for electrification products thus increased to almost €7 billion.

Divisional results for Vitesco Technologies

The Powertrain Solutions division generated sales of €1.41 billion in the third quarter of 2023 (Q3 2022: €1.63 billion), which equates to an organic decrease of 8.2 percent. In the same period, adjusted EBIT improved to €98.1 million (Q3 2022: €73.9 million). The adjusted EBIT margin therefore stood at 6.9 percent (Q3 2022: 4.6 percent). The planned reduction in sales in the non-core business and ongoing cost containment measures had a positive impact on the division’s earnings.

The Electrification Solutions division achieved a further increase in sales due to a persistently high demand, especially in Asia and Germany. The division generated sales of €799.7 million in the third quarter (Q3 2022: €687.1 million), which equates to organic growth of 21.8 percent. Despite ramp-up costs for new electrification projects, adjusted EBIT improved to a loss of €14.3 million (Q3 2022: loss of €23.6 million), which equates to an adjusted EBIT margin of minus 1.8 percent (Q3 2022: minus 3.4 percent).

Guidance for 2023 confirmed

Vitesco Technologies is confirming its outlook for 2023. The company continues to anticipate sales of €9.2 billion to €9.7 billion. Vitesco Technologies is also expecting the adjusted EBIT margin for 2023 to be in a range of 2.9 percent to 3.4 percent and free cash flow to be around €50 million.

© Vitesco Technologies GmbH (exclusive rights)