.jpg?width=407&resizemode=force)

The Vitesco Technologies Group became part of the Schaeffler Group as of October 1, 2024, due to the merger of Vitesco Technologies Group AG into Schaeffler AG.

Please note: Legal or actual changes since October 1, 2024, are therefore no longer reflected in the content of the website.

As the website is no longer updated, we assume no liability for the content of this website, or the linked websites contained therein. The operators of the linked sites are solely responsible for their content.

Irrespective of this, you can still find the current BPCoC and the General Terms and Conditions of Purchase at Vitesco Technologies - Suppliers (vitesco-technologies.com)

Under the following link you will find the current Schaeffler website:

.jpg?width=407&resizemode=force)

Regensburg, March 25, 2022. Vitesco Technologies, a leading international provider of modern drive technologies and electrification solutions for sustainable mobility, today published its consolidated financial statements for fiscal year 2021. Preliminary figures had already been reported on February 21 – the company fully met its forecast for 2021 for all key financial figures.

2021 was a milestone year for Vitesco Technologies: the spin-off from Continental AG, the stock exchange listing in September with a transaction volume of around € 2.4 billion, and, finally, the inclusion in the SDAX index in December.

Further rise in sales and increasing order intake for electrification products

Vitesco Technologies performed well in 2021 despite a continued challenging market environment. Vehicle production stagnated in North America; Europe recorded a decline. Production volumes in China recovered and even grew slightly. In the past financial year, ongoing supply bottlenecks and semiconductor shortages weighed on global market growth for passenger cars and light commercial vehicles.

With its strong international presence and established market position in these core markets, Vitesco Technologies achieved sales growth despite difficult economic conditions: Vitesco Technologies raised its group sales organically by 4.1 percent to € 8.3 billion in fiscal year 2021 (2020: € 8.0 billion). With an increase of 44.6 percent, business unit Electrification Technology recorded the strongest organic growth of all units. The adjusted EBIT-margin of business unit Electrification Technology improved by around 39 percentage points. Electrification products accounted for € 888 million of sales.

Adjusted EBIT amounted to € 148.6 million in FY 2021 (2020: € -94.5 million). The adjusted EBIT margin at 1.8 percent (2020: -1.2 percent) was slightly above the announced target range of 1.5 percent to 1.7 percent. Operating profit (EBIT) climbed to € 39.5 million (2020: € -324 million).

With a free cash flow of € 113.3 million (2020: € -455.7 million), the company reached the upper end of the projected bandwidth of € 70 to 120 million. The increase is attributable to significant operating improvements and was achieved despite higher capital expenditure.

The balance sheet of Vitesco Technologies remains very solid with an equity ratio of 36.3 percent as of December 31, 2021 (December 31, 2020: 32.9 percent). The group’s net liquidity stood at € 345.1 million at the end of the fiscal year (December 31, 2020: € 405.7 million).

Despite the challenges presented by the markets, Vitesco Technologies recorded a total order intake of € 11.2 billion in the fiscal year 2021, with electrification products contributing € 5.1 billion. The volume of new orders booked was over € 4.8 billion in the fourth quarter alone. Electrification products accounted for more than half of this volume; order intake amounted to € 2.5 billion, of which € 2.0 billion were attributable to business unit Electrification Technology.

Vitesco Technologies was able to further expand its electrification business in the past year. Order intake for high-voltage inverters amounted to more than € 2.5 billion. Incoming orders for electric axle drives worth € 1.1 billion also contribute to the successful implementation of the company’s e-mobility strategy. Overall, Vitesco Technologies has an order backlog of more than € 51 billion, 33 percent of which is in the electrification area.

Proposed waiver of dividend

For the year 2021, the consolidated net income attributable to shareholders came in at € ‑122.0 million. Earnings per share amounted to € ‑3.05.

No dividend proposal will be submitted for resolution to the Annual General Meeting on May 5, 2022. In the financial year 2020 there were paid no dividends as well, as Vitesco Technologies was still part of Continental AG at that time.

Outlook 2022: Normalization of semiconductor supply expected – consequences of the Russian war in Ukraine not yet assessable

Until now, Vitesco Technologies expected that the first half of the year would still be impacted by semiconductor supply shortages with effects on production volumes. To date, the company expects a slow normalization of the supply situation in the second half of 2022 with noticeable effects in the fourth quarter.

Vitesco Technologies expects the strongest increase in production volumes of passenger cars and light commercial vehicles in 2022 for Europe in the range of 17 to 19 percent. According to the company's estimates, production volume in North America will increase by 15 to 17 percent, while it assumes a slight increase of 0 to 2 percent for production figures in China.

Sales and EBIT expectations above previous year’s level – Electrification business is a “growth engine”

Against the backdrop of rising production figures as well as the supporting trend toward electrification, Vitesco Technologies expects group sales in the amount of € 8.6 to 9.1 billion in fiscal year 2022. The expected reduction in sales from contract manufacturing for Continental AG and from the company’s non-core technologies have a counteracting effect.

For the 2022 adjusted EBIT-margin, Vitesco Technologies assumes a range between 2.2 percent and 2.7 percent. Anticipated additional costs resulting from semiconductor supply shortages, wage inflation as well as rising material costs are already included in this estimate. The company forecasts a burden due to special effects of around € 100 to 150 million in 2022.

Capital expenditures without consideration for right-of-use-assets in accordance with IFRS 16 are expected to be at about 6 percent of sales.

Vitesco Technologies plans to achieve a free cash flow of more than € 50 million in 2022.

Sustainability strategy to be launched on March 29

The company also used 2021 to develop an ambitious sustainability strategy and its first sustainability report. It will present both on March 29, 2022.

By 2030, Vitesco Technologies wants to achieve climate neutrality for the entire production and for its own business activities. The company has also set itself the ambitious goal of making its entire value chain climate neutral by 2040 at the latest. This also includes all business activities outside the company's own processes - from the extraction of raw materials to the use of products.

© Vitesco Technologies GmbH (exclusive rights)

Andreas Wolf, CEO of Vitesco Technologies

© Vitesco Technologies GmbH (exclusive rights)

The headquarters of Vitesco Technologies in Regensburg.

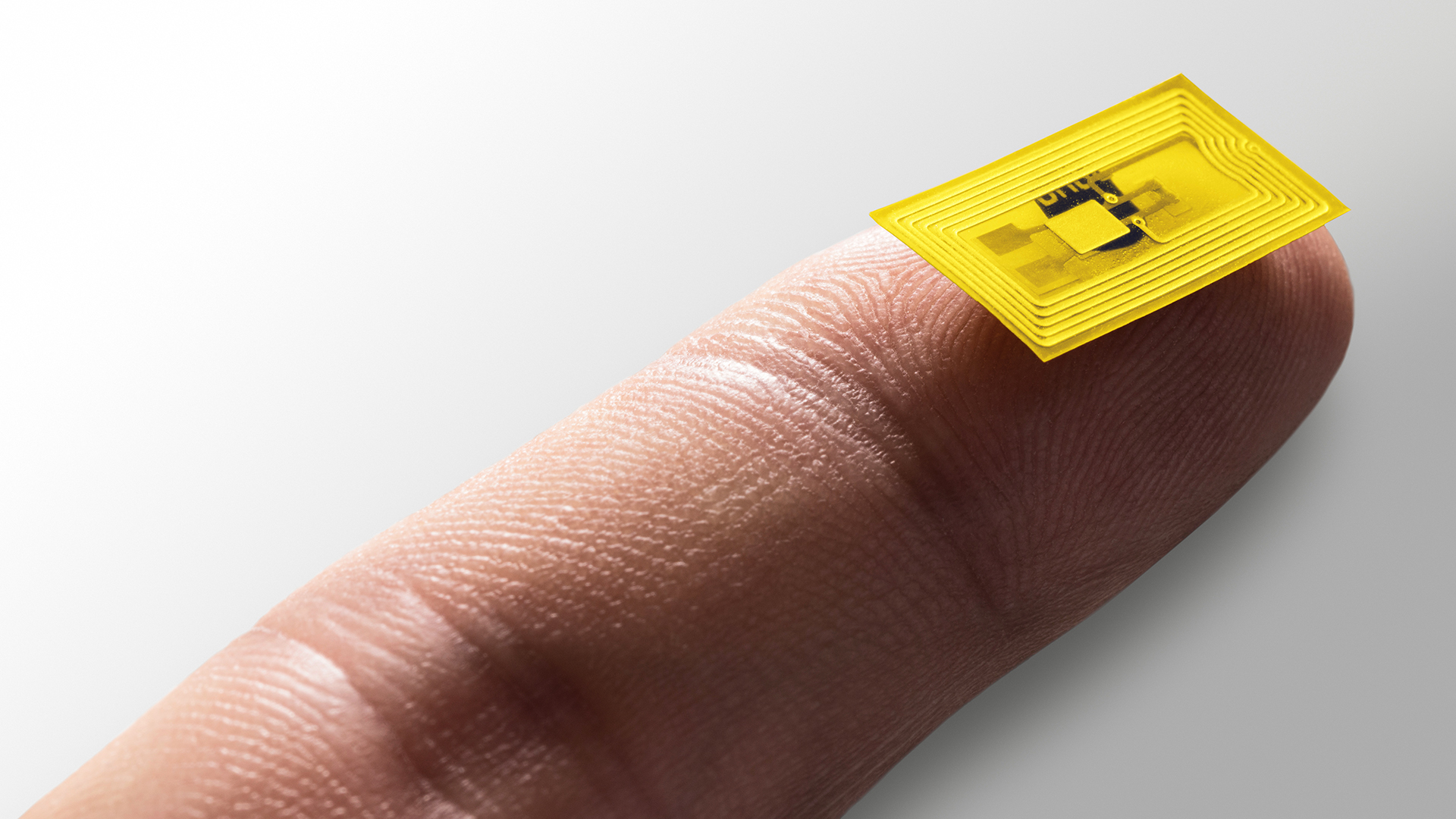

© Vitesco Technologies GmbH (exclusive rights)

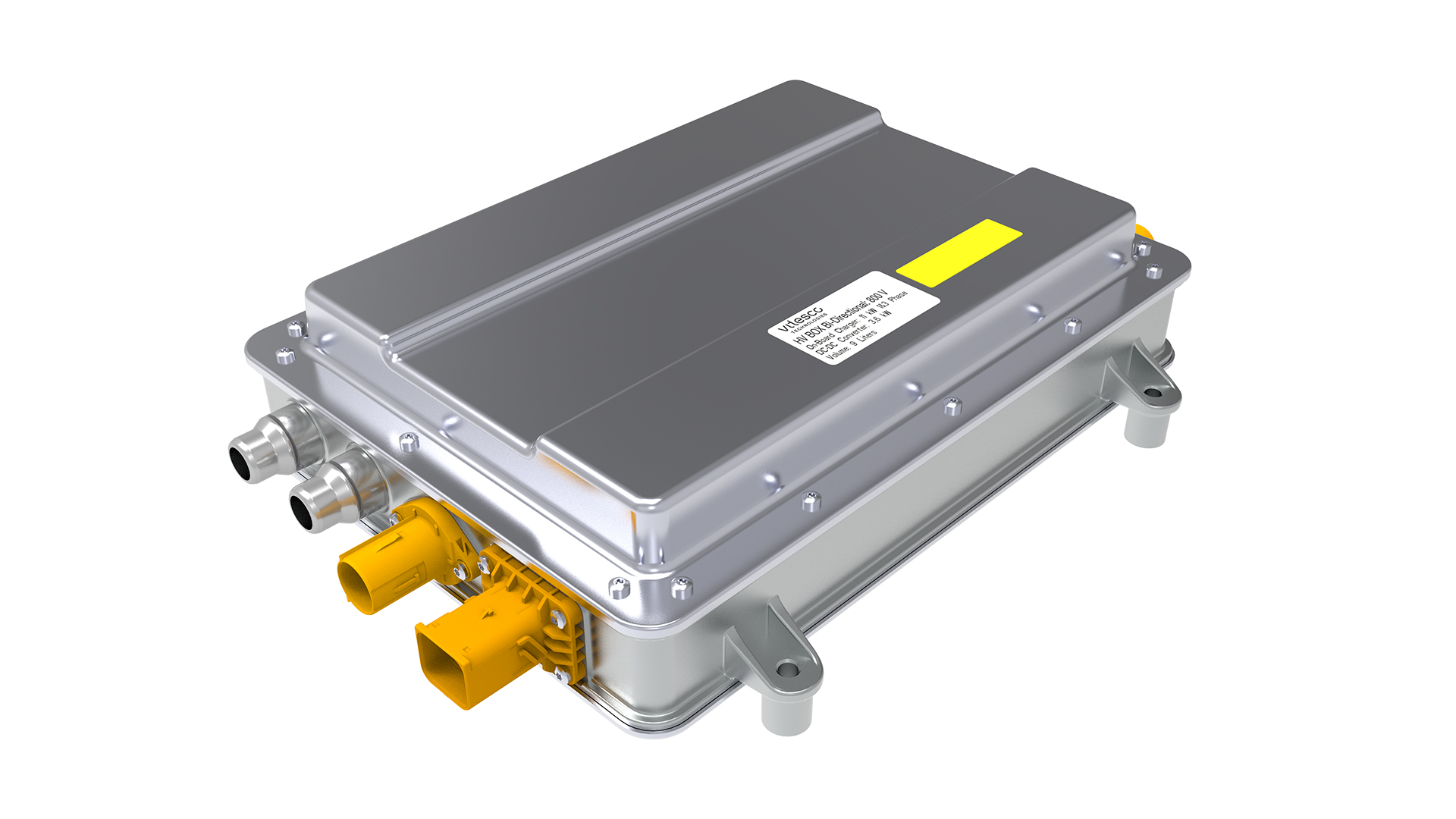

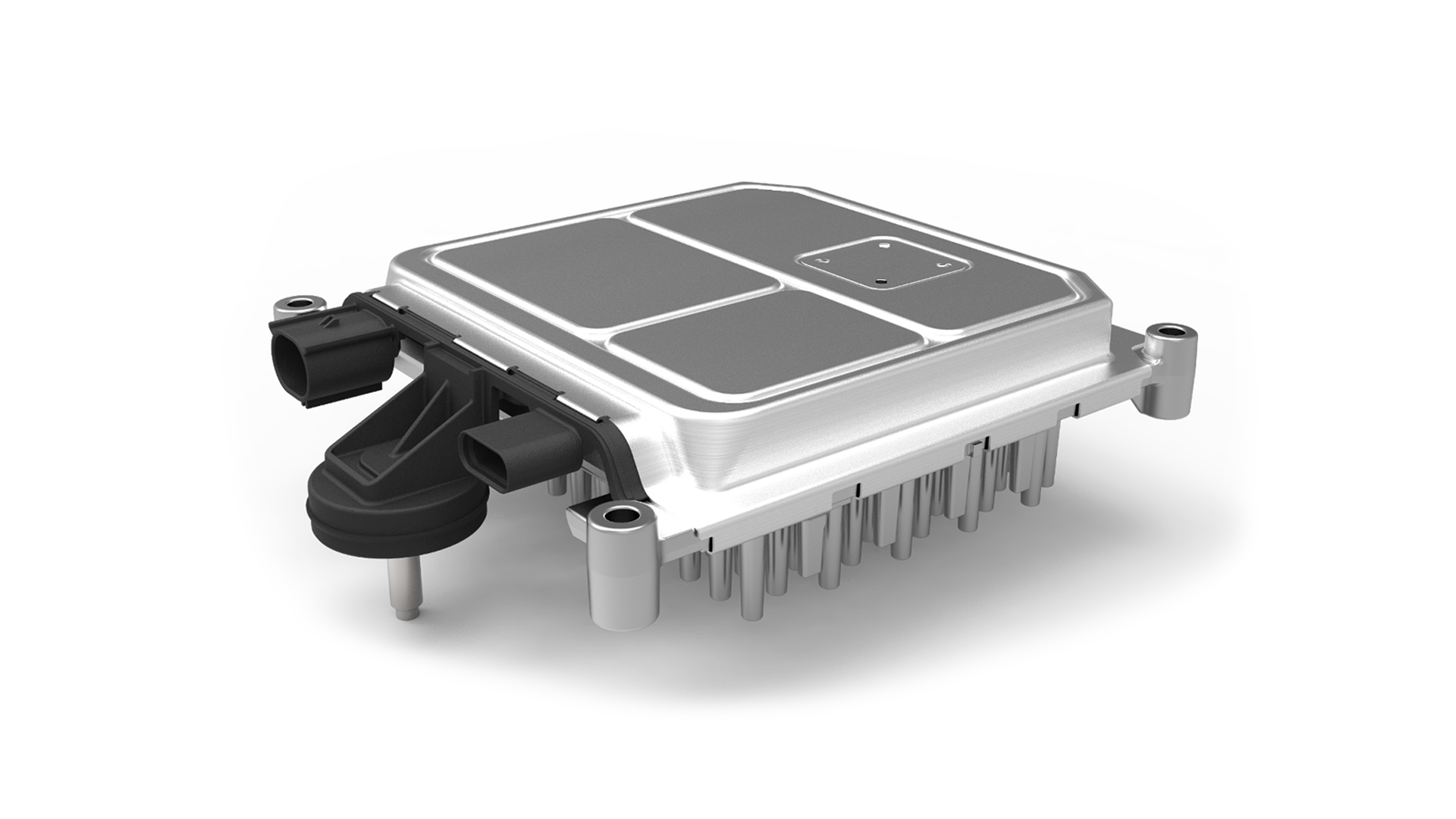

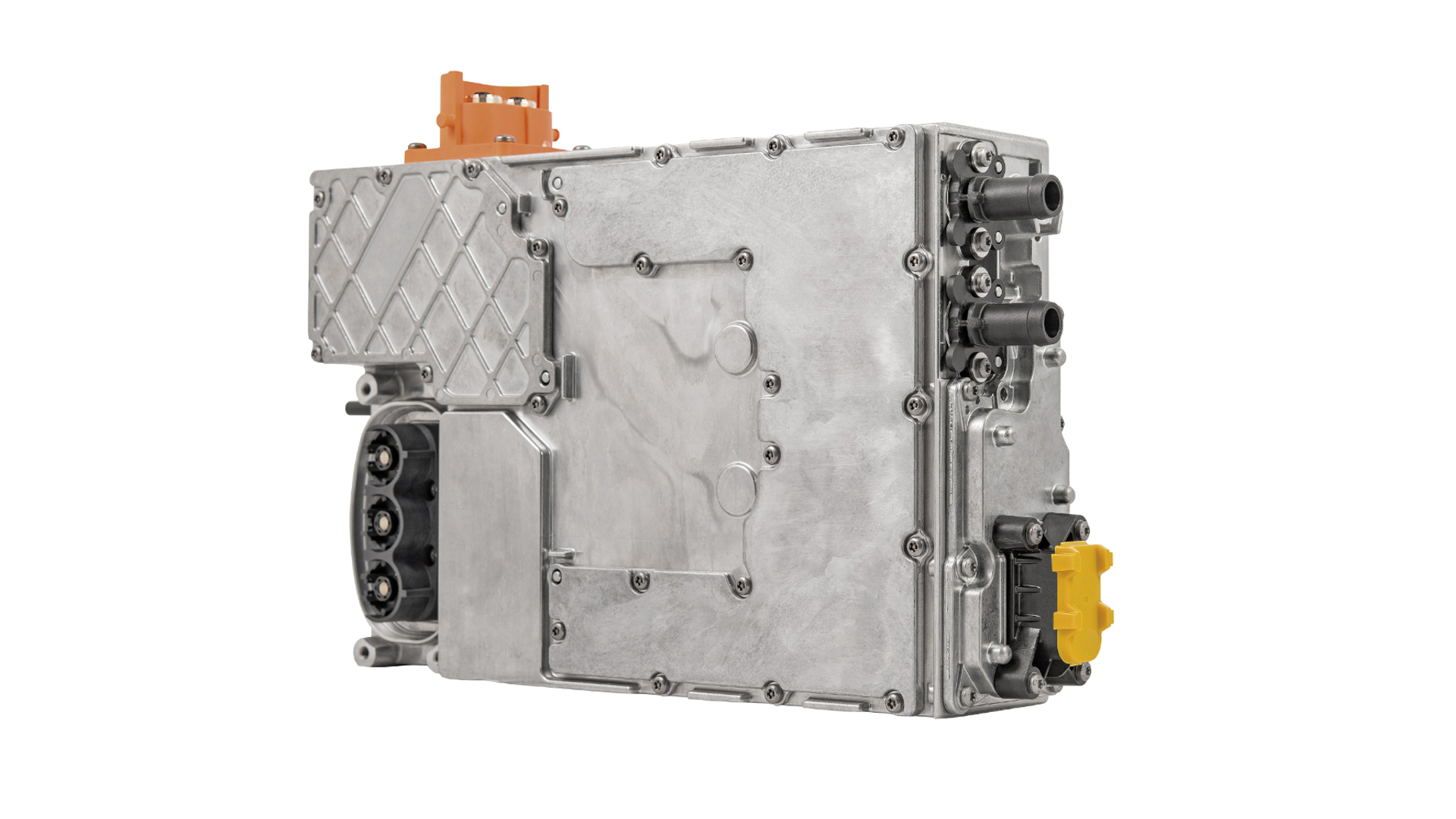

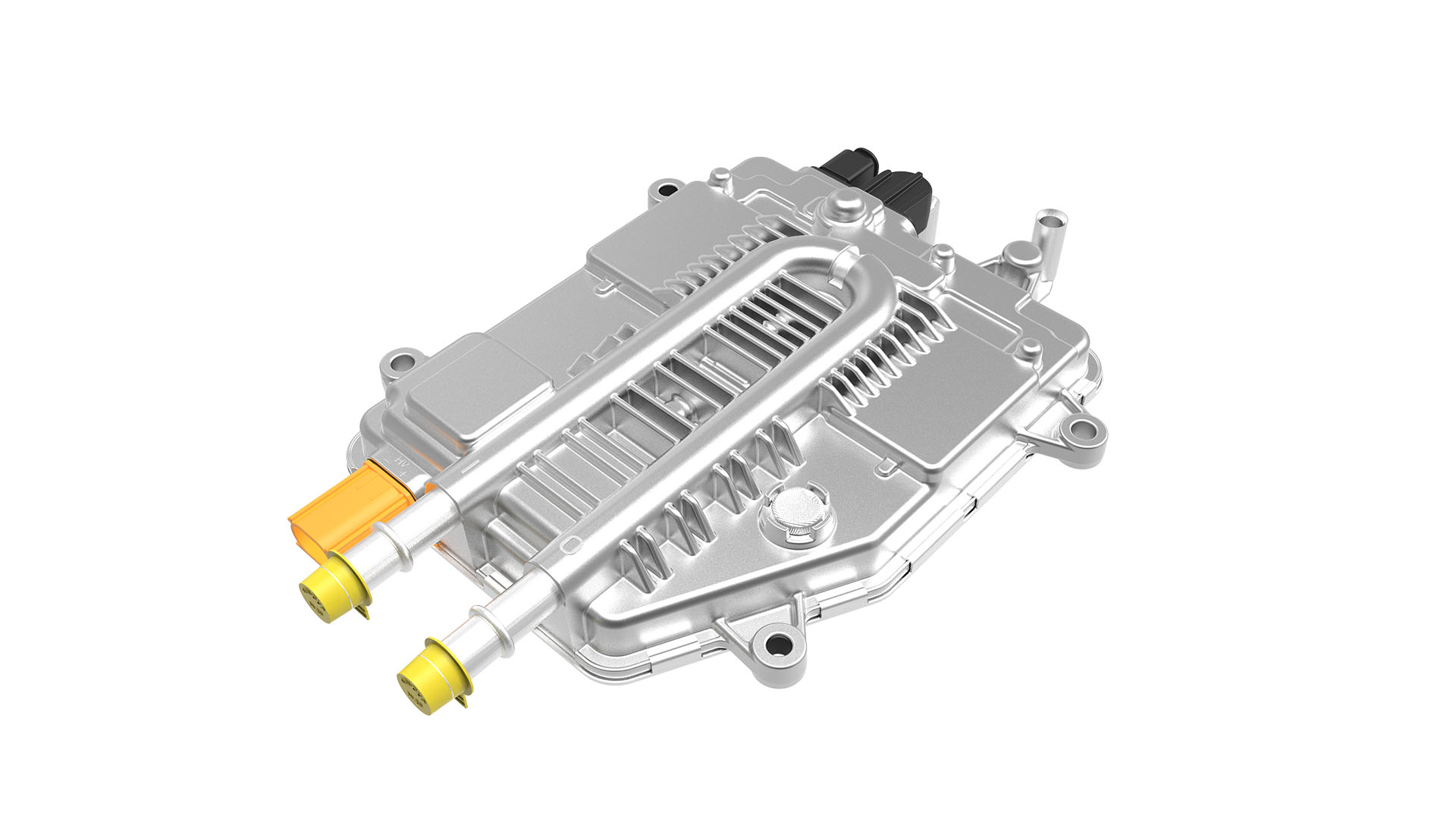

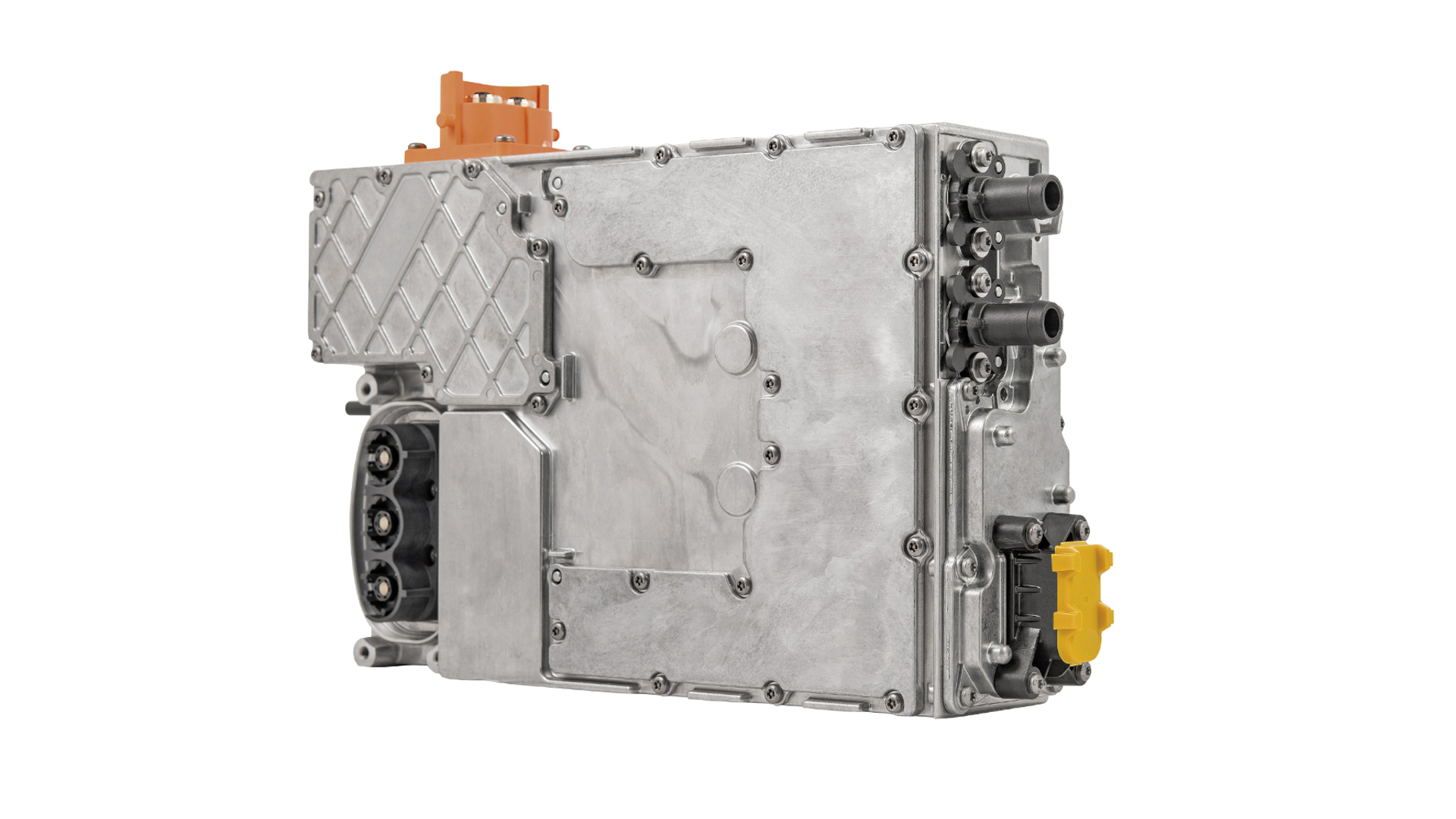

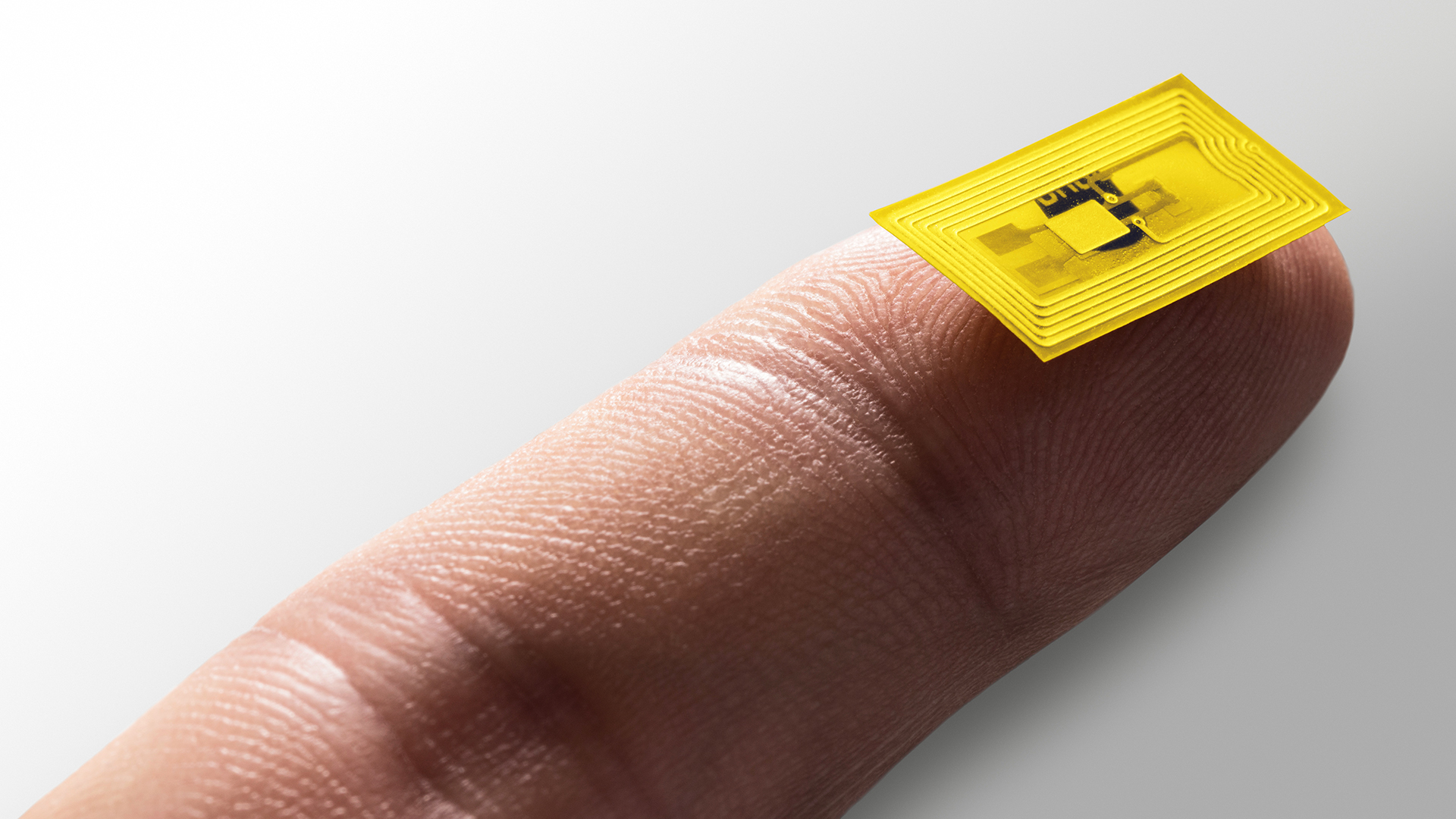

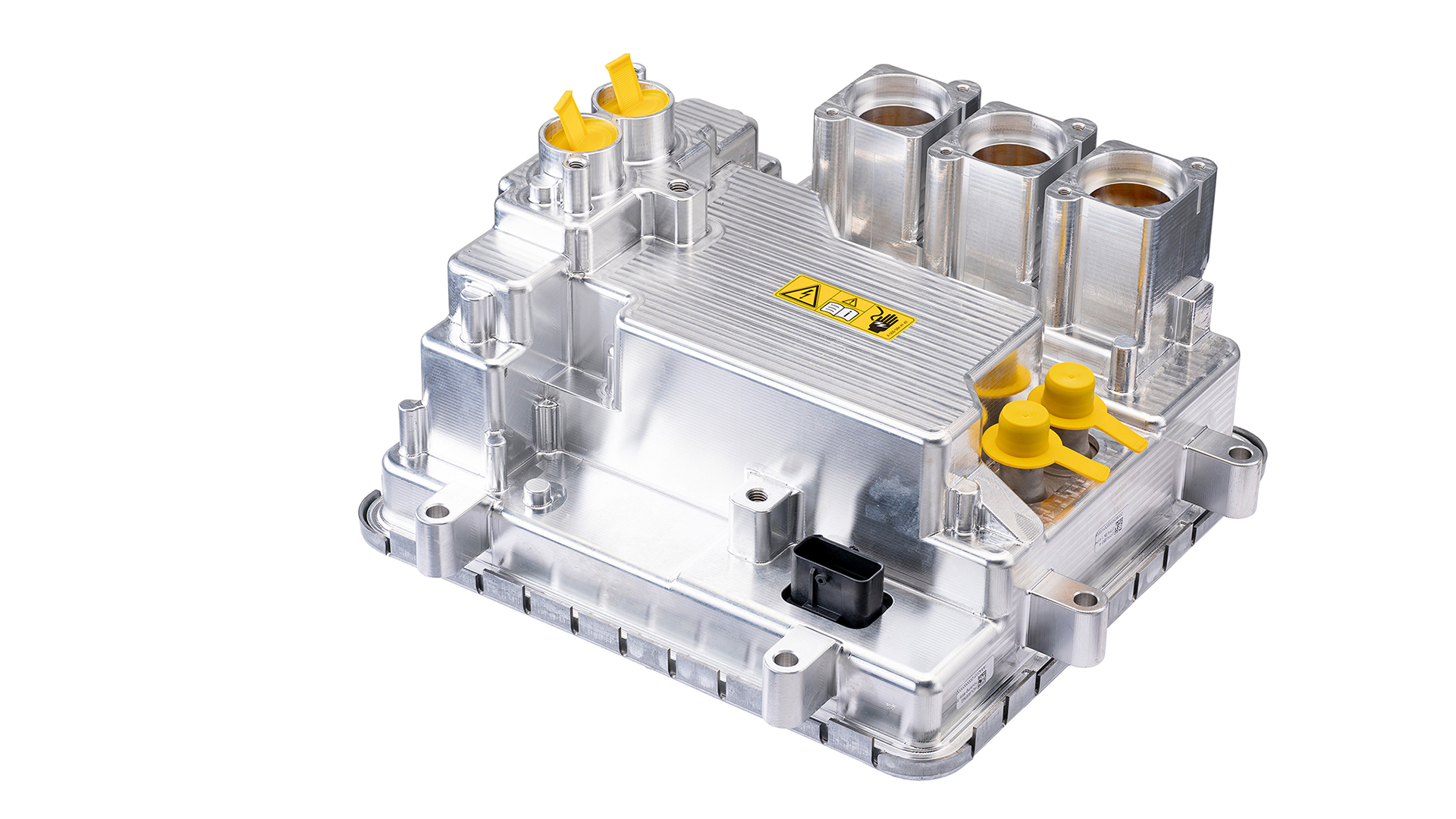

Production of power electronics at Vitesco Technologies

© Vitesco Technologies GmbH (exclusive rights)

Production of power electronics at Vitesco Technologies

© Vitesco Technologies GmbH (exclusive rights)

Vitesco Technologies sets an ambitious climate target: CO2-neutral value chain by 2040 at the latest.

© Vitesco Technologies GmbH (exclusive rights)

Vitesco Technologies CEO Andreas Wolf (right) and CFO Werner Volz (left).

© Vitesco Technologies GmbH (exclusive rights)

Werner Volz, CFO of Vitesco Technologies

© Vitesco Technologies GmbH (exclusive rights)

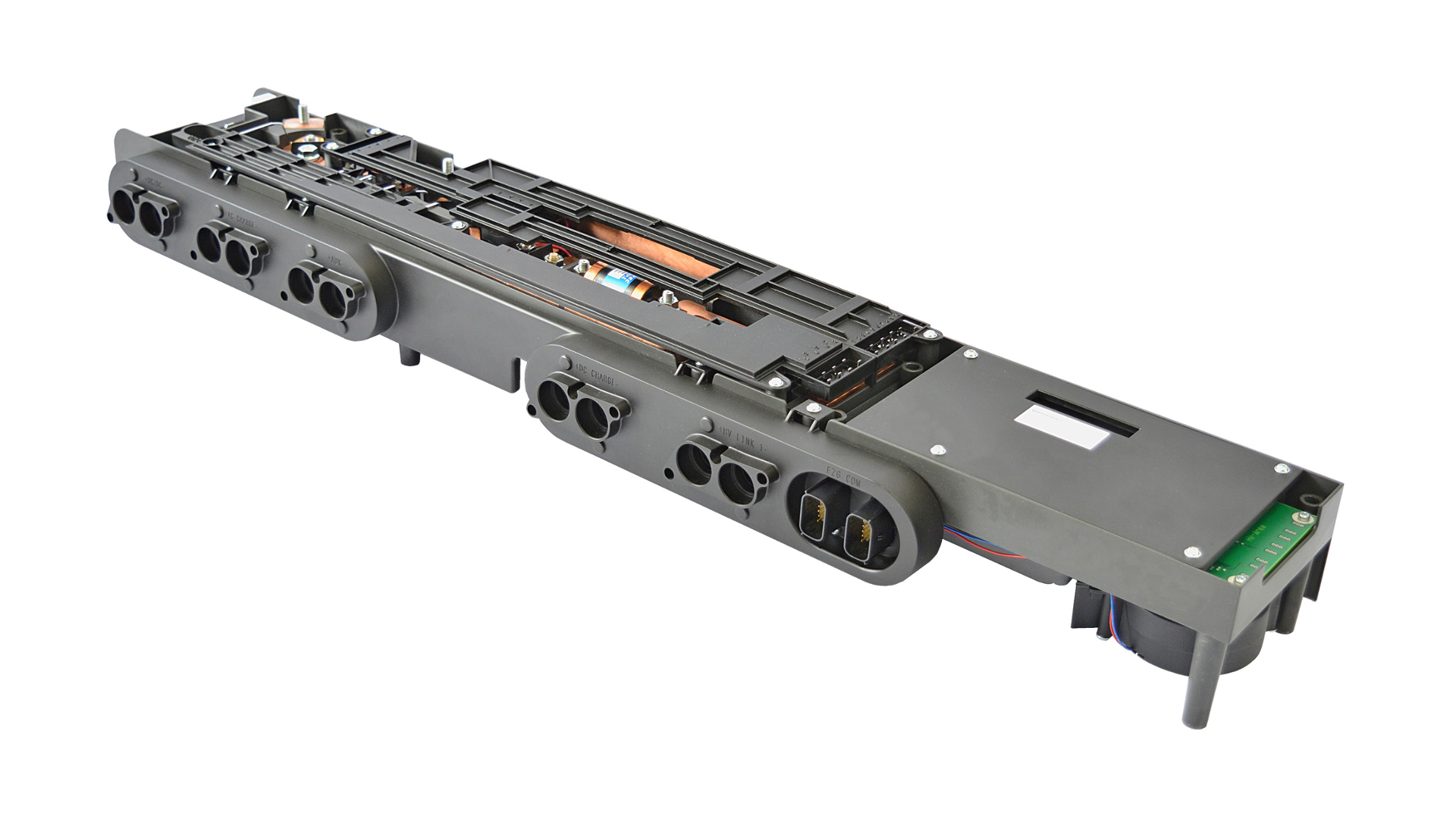

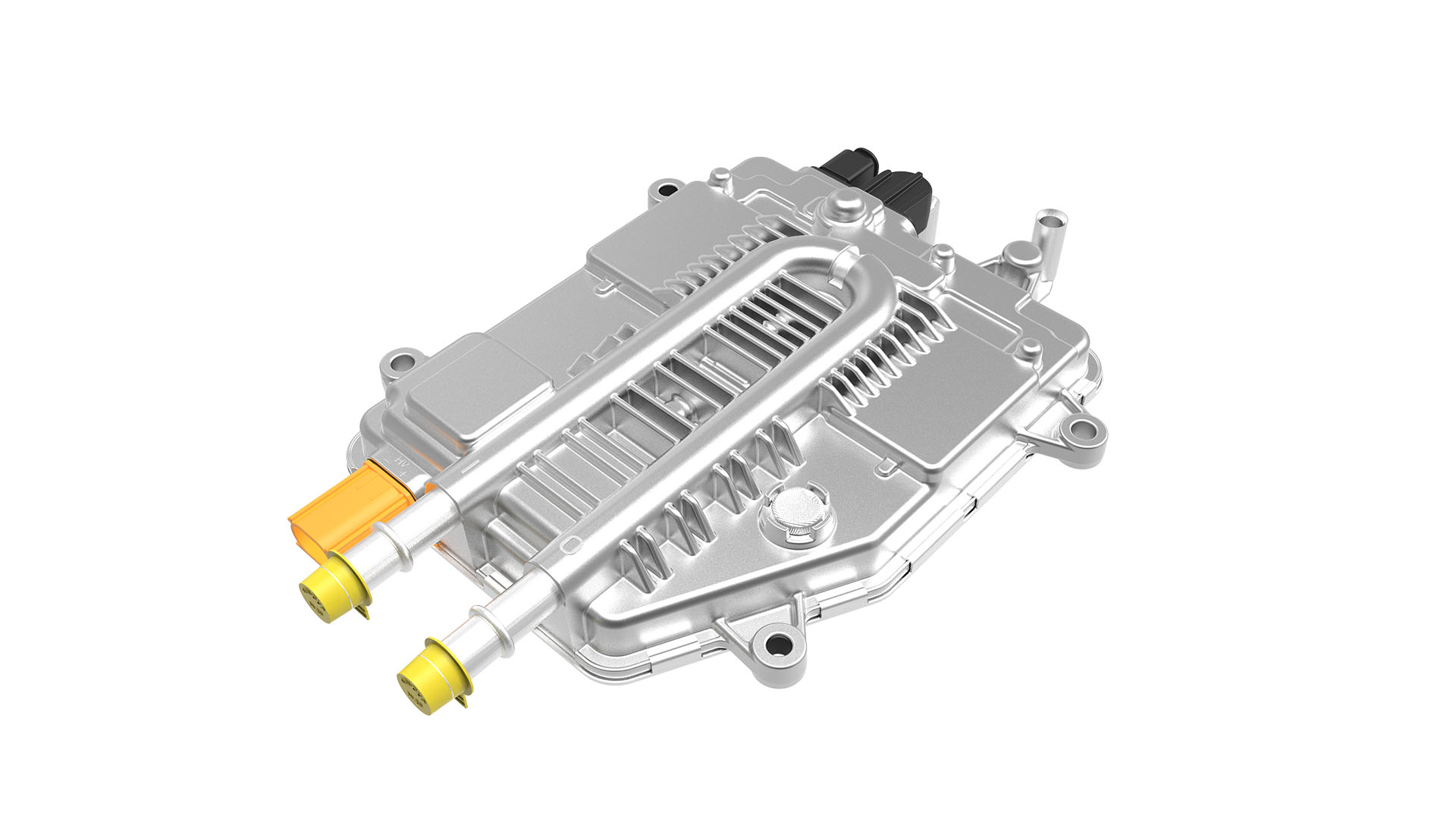

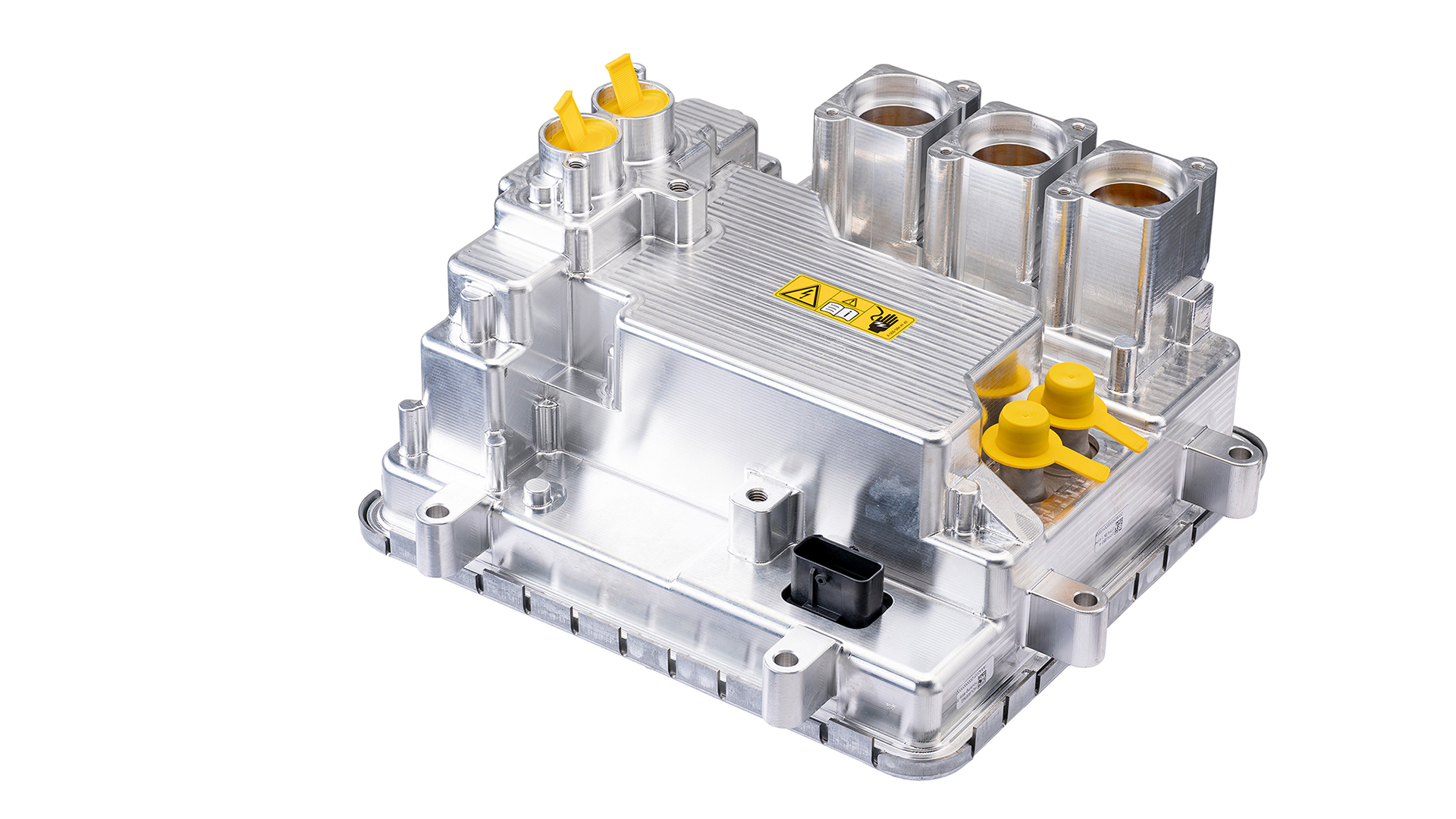

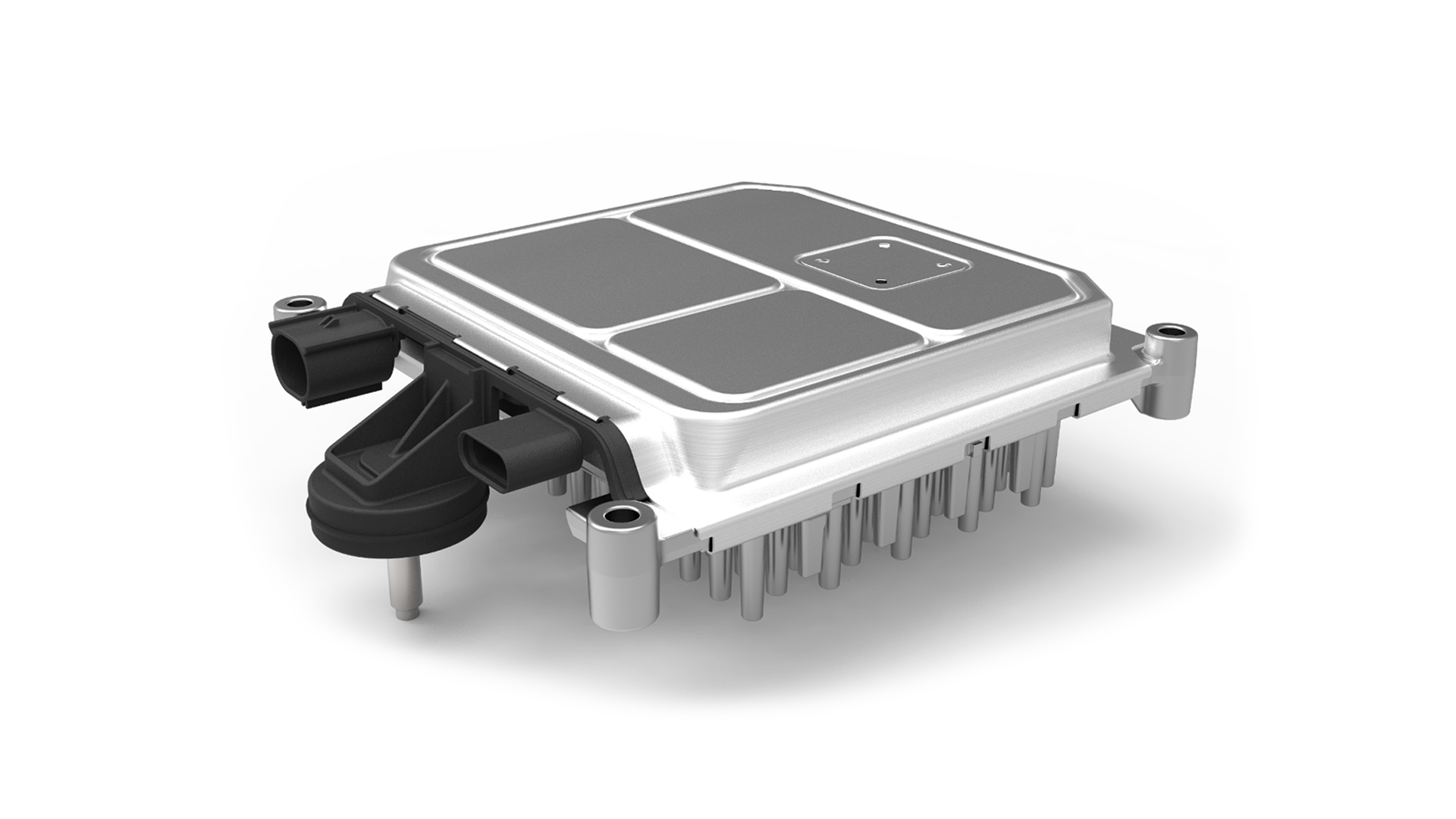

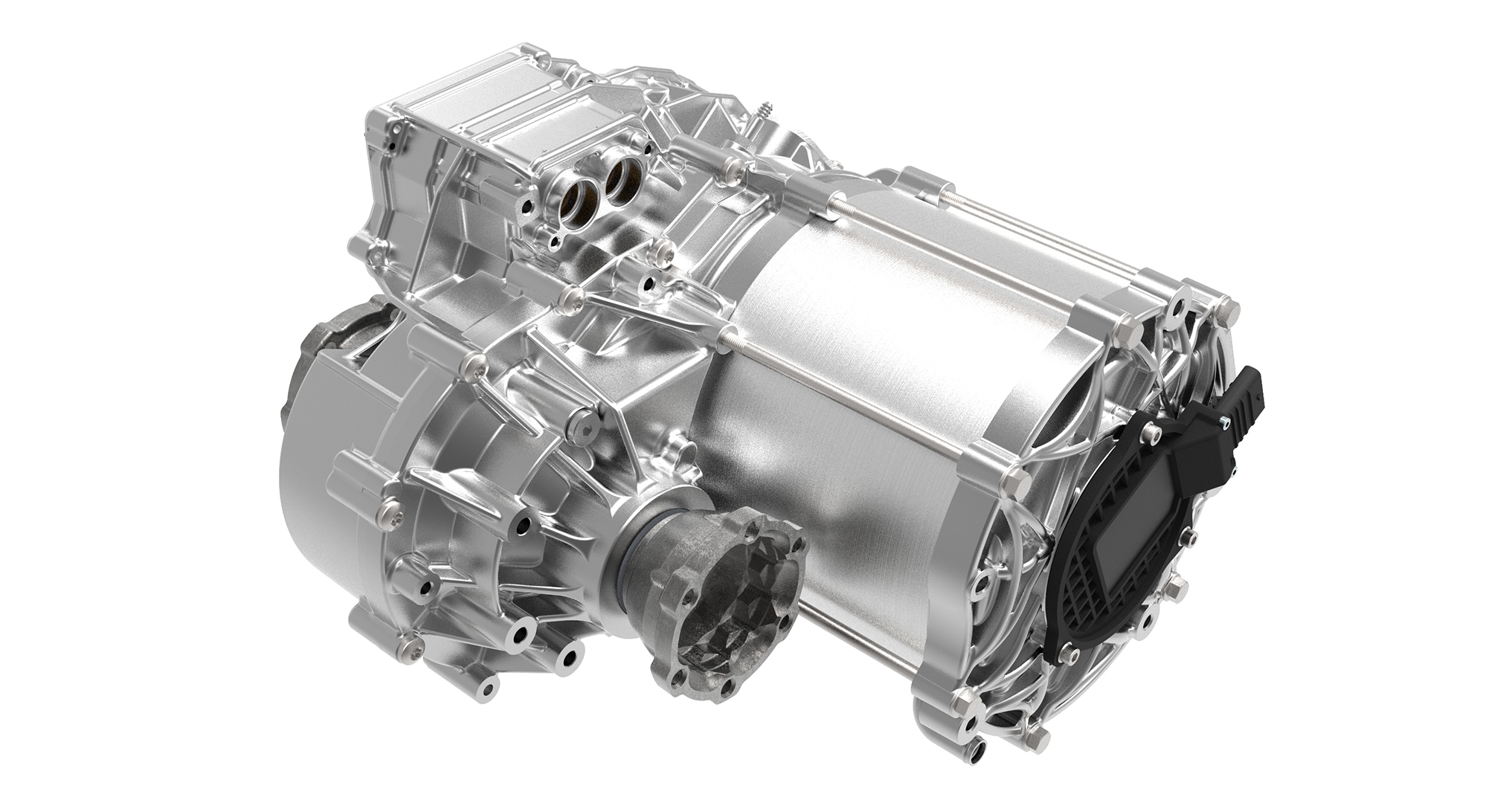

EMR4 platform

© Vitesco Technologies GmbH (exclusive rights)